Report Terminations

Employers help when they report an employee or independent contractor's termination as soon as possible, especially when they provide the name and address of the new employer. A withholding notice can be sent to the new employer, and the family can continue to receive regular payments.

Income Withholding: Employee Termination

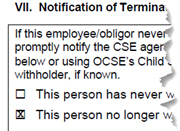

View Illustration: IWO Termination

To notify us when an employee or independent contractor with a child support obligation leaves your employ, please complete the section Notification of Employment Termination on the last page of the Income Withholding for Support (PDF).

This notification asks you to indicate that the person no longer works for you (or never worked for you) and to provide the following information:

- Termination date

- Employee/obligor's last known address and phone number

- Final payment date and amount

- New employer's or income withholder's name and address

When you have completed this information on the last page of the Income Withholding for Support, mail a copy to

NYS Child Support Processing CenterPO Box 15368

Albany, NY 12212-5368

There is no specific penalty for failing to report when an employee or independent contractor leaves, but if you just stop withholding, you may receive noncompliance notices and become subject to penalties for failure to withhold and remit support payments as ordered. When you report a terminated employee, we are able to update our records accordingly. If you require an official cancellation of your obligation to withhold income for support, a termination IWO can be sent to you upon request.

Health Insurance Withholding: Employee Termination

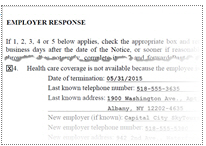

View Illustration: Medical Support Termination

If you have received a National Medical Support Notice (PDF) for the employee or independent contractor, you should report the employee or independent contractor's termination by completing Part A (Item 4 of the EMPLOYER RESPONSE) (PDF). Check Item 4 to indicate that health insurance coverage is no longer available for the employee and provide the following information:

- Date of termination

- Employee/Obligor's last known phone number

- Employee/Obligor's last known address

- New employer's name, address, and phone number

Be sure to complete the "Contact for Questions" section. Keep a copy for your records and mail the completed Part A to the Issuing Agency.