Withholding Limitations Worksheet

Lump sum payments

Use the Withholding Limitations Worksheet for Support and Medical Support (PDF) and the New York State Income Withholding for Support (PDF) to calculate the withholding amount. Note: You may also need the amount of the health insurance premium, if you received a National Medical Support Notice (PDF) for the dependents listed on Page 1 of the income withholding order. The online income withholding calculator, based on the Withholding Limitations Worksheet, is an additional tool to calculate income withholding.

New York State regulations require that support obligations be fulfilled in this order:

- Current support obligation amounts

- Full amount of health insurance premium

- Arrears—past-due support obligations and other amount, if any

Calculation of withholding requires you to determine the following values for the employee or independent contractor:

- Disposable income

- Maximum Withholding allowed under the Consumer Credit Protection Act (CCPA)

- Income withholding amounts

- Health insurance premium

- Proration of Maximum Withholding

- Amounts to withhold and remit

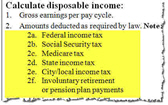

Disposable income

View Illustration: deductions

Disposable income equals the earnings left after certain required deductions from gross pay. New York State law requires the following six deductions:

- Federal income tax

- Social Security tax (FICA)

- Medicare tax

- State income tax

- City/local income tax

- Involuntary retirement or pension plan payments

Subtract the total of these deductions from the employee or independent contractor's gross pay. Note: This amount is the employee's "disposable income" for the purposes of child support withholding. This amount may not be the same as the employee's net pay.

Maximum Withholding: CCPA limitations on withholding

The Consumer Credit Protection Act (CCPA) limits withholding for child support. The maximum that can be withheld for support may range from 50–65% of an employee or independent contractor's disposable income. The CCPA limitation percentage depends on up to three factors: (1) the date of the IWO; (2) the arrears duration (if any); and (3) for older IWOs, the employee's other dependents. The CCPA limitation percentage depends on the answers to these questions:

- Is the date of any IWO August 29, 2018 or later?

If so, select "Yes" and proceed to the next item, the employee's arrears status. Only the date of the IWO(s) and the arrears status affect the limitation percentage for IWOs issued on or after August 29, 2018.

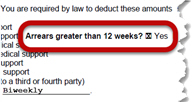

If all the employee's IWOs are dated before August 29, 2018, select "No" and the third item will be displayed. Make selections for the employee's arrears status and other spouse or child. - View Illustration: arrears check box

Does the employee or independent contractor owe arrears greater than 12 weeks on any IWO?

Does the employee or independent contractor owe arrears greater than 12 weeks on any IWO?

Check the first page of each IWO. If the employee owes arrears greater than 12 weeks, the "Yes" box in the Order Information section will be checked.

Note: If this box is checked on any IWO for the employee, you must answer "Yes" to this question. - Does the employee or independent contractor support another spouse or child besides those listed in this IWO?

This item will be displayed only if you selected "No" to indicate that all the employee's IWOs are dated before August 29, 2018.

If you have received more than one IWO for this employee, answer "Yes." If you don't know whether the employee supports another spouse or child, check the employee's W-4 form or ask the employee.

The following table shows the Maximum Withholding limitation percentage for each combination of factors: date of IWO, arrears status, and (if applicable) other dependents.

| CCPA Maximum Withholding Limitation Percentage | ||

|---|---|---|

| Any IWO issued on or after August 29, 2018 | ||

| No arrears OR Arrears less than 12 weeks | Arrears greater than 12 weeks | |

| 50% | 55% | |

| All IWOs issued before August 29, 2018 | ||

| Other dependents | No arrears OR Arrears less than 12 weeks | Arrears greater than 12 weeks |

| Yes: Employee supports another spouse or child | 50% | 55% |

| No: Employee does NOT support another spouse or child | 60% | 65% |

For example, if the IWO was issued before August 29, 2018, the employee supports other dependents and owes arrears greater than 12 weeks, then the correct CCPA limitation percentage is 55% or 0.55.

To calculate the Maximum Withholding amount for this employee, multiply the disposable income by 0.55.

Compare the total for all IWOs to the Maximum Withholding

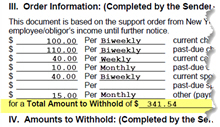

View Illustration: total to withhold

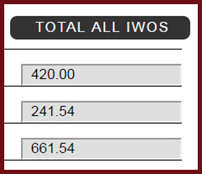

Should you withhold the Maximum Withholding or a lesser amount? To be sure, find the Total Amount to Withhold for each IWO you received for this employee or independent contractor. The IWO total is shown directly below the Order Information on the first page of the IWO. For the example in the illustration, the total is $341.54 biweekly.

Be sure to choose the amount that matches your pay cycle. Under AMOUNTS TO WITHHOLD, the total is shown for various pay cycles. If your pay cycle is weekly, for instance, for this IWO you would withhold $170.77.

Add the Total Amount to Withhold from each IWO you received for the employee, along with the employee's share of the court-ordered health insurance premium (if any), for your pay cycle. Compare this total to the Maximum Withholding. If the total is less than or equal to the Maximum Withholding, your calculation is complete at this point. Withhold this total (all IWOs and health insurance premium). If the total is more than the Maximum Withholding, continue with the Proration of Income Withholding Amount(s).

Proration of income withholding amounts

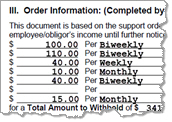

Order Information: Obligation types and amounts

View Illustration: ordered amounts

In the Order Information section on the first page of the IWO, you will see various types of obligations listed—"current child support," "past-due child support," "other (payments to a third or fourth party)"—along with the frequency (e.g., biweekly, weekly, monthly). In the prorated calculation, these amounts must be treated separately because of the CCPA limits on withholding. Depending on the Maximum Withholding for the employee or independent contractor, past-due and other amounts may receive only partial payment or no payment; the health insurance premium may or may not be paid.

Convert ordered amounts to your pay cycle (if needed)

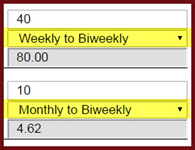

View Illustration: pay frequency conversion

First, note the ordered payment frequency for the IWO as a whole. In the example, the IWO total is to be paid biweekly. If your pay period is also biweekly, no conversion is required for any amounts listed as biweekly. However, this IWO lists several amounts to be paid at different frequencies, such as "current cash medical support" at $40 weekly, "past-due cash medical support" at $10 monthly, and "other (payments to a third or fourth party)" at $15 monthly. You must convert each of these amounts to the biweekly amount to match your pay cycle.

Yearly payment frequency values for the most common pay cycles are listed below:

- Weekly: 52 payments per year

- Biweekly: 26 payments per year

- Semi-monthly: 24 payments per year

- Monthly: 12 payments per year

The general formula to convert to another pay cycle follows:

Again, for the sample case, the IWO orders payments at various frequencies, but your pay cycle is biweekly. Here are the biweekly amounts to use to calculate withholding:

| Obligation type | Amount | Frequency | Convert | Withhold |

|---|---|---|---|---|

| Current child support | $100.00 | Biweekly | none | $100.00 |

| Past-due child support | $110.00 | Biweekly | none | $110.00 |

| Current cash medical support | $40.00 | Weekly | (40 × 52) ÷ 26 | $80.00 |

| Past-due cash medical support | $10.00 | Monthly | (10 × 12) ÷ 26 | $4.62 |

| Current spousal support | $40.00 | Biweekly | none | $40.00 |

| Past-due spousal support | $0.00 | Biweekly | none | 0.00 |

| Other (payments to third or fourth party) | $15.00 | Monthly | (15 × 12) ÷ 26 | $6.92 |

| IWO total | $341.54 | |||

"Arrears-only" obligation?

View Illustration: arrears-only obligation

You may have an employee or independent contractor with an IWO where the only obligation type is for arrears—past-due or other amounts. Be sure to enter the amount under "past-due" or "other," as identified in the IWO. New York State law requires that current support obligations and dependent health insurance be paid before any past-due or other amounts. If the employee's earnings are not enough to fulfill all obligations, an IWO with an arrears-only obligation may not receive any payment.

Include amounts from all orders

View Illustration: total from all notices

If you have received more than one IWO for the employee or independent contractor, withhold the total amount for all orders combined. Remember to convert the amounts, if necessary, to withhold the amounts for your pay cycle.

When to prorate the Maximum Withholding

If the employee or independent contractor's obligations exceed the Maximum Withholding and the employee has more than one Income Withholding Order (IWO), the obligations that make up the Maximum Withholding amount must be prorated among the IWOs so that each IWO receives its share of the payment. When you submit your payment, be sure to identify the prorated amount for each IWO. Detailed sample cases show how to prorate the Maximum Withholding in the following situations:

- Case A: Current obligation and the health insurance premium are paid in full; arrears are prorated.

- Case B: Current obligation is paid in full, but the health insurance premium cannot be paid; arrears amounts are prorated.

Note: The health insurance premium must be paid in full or not at all. The premium cannot be prorated. - Case C: Current obligation amounts are prorated; the health insurance premium and arrears cannot be paid.

The following table shows the required sequence of steps to decide when to withhold for dependent health insurance and what to prorate. Begin at Item 1 and compare the total of all obligations (current support, arrears, and health insurance) with the Maximum Withholding.

| Proration and health insurance withholding | |||

|---|---|---|---|

| If the sum of these obligation types is… | Greater than the Maximum Withholding | Less than the Maximum Withholding | Withhold health insurance? |

| 1. Total current obligations + health insurance premium + total arrears | Continue to 2 ↓ | Withhold current, premium and arrears | Yes |

| 2. Total current obligations + health insurance premium | Continue to 3 ↓ | Withhold current and premium. If remainder, prorate arrears (Case A) | Yes |

| 3. Total current obligations + arrears | Continue to 4 ↓ | Withhold all current and arrears | No |

| 4. Total current obligations | Prorate current (Case C) | Withhold all current and prorate arrears (Case B) | No |

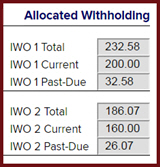

Amounts to withhold and remit

View Illustration: calculator results

If possible, the final amount to withhold for the employee or independent contractor will include the Total Amount to Withhold for all IWOs and the full amount of the health insurance premium. However, the amount you remit to the Processing Center must include only the withholding for support—not the health insurance premium.

For the example described above (total current obligations $360.00, health insurance premium $45.00, plus arrears of $160.00), you would withhold the full $463.65 but remit $418.65 to the Processing Center.